In a world brimming with insurance options, finding the right coverage can feel like navigating a labyrinth. Whether you’re safeguarding your health, assets, or loved ones, selecting the ideal insurance plan is crucial. This comprehensive guide aims to demystify the insurance landscape, empowering you to make informed choices that align with your unique needs and preferences.

Understanding Insurance Basics

Insurance serves as a safety net, offering financial protection against unforeseen circumstances. Before delving into the specifics of selecting a plan, it’s essential to grasp the fundamental concepts that underpin the insurance industry.

Insurance Principles Demystified

Embark on your insurance journey by acquainting yourself with the core principles governing insurance contracts. Understanding concepts such as utmost good faith, indemnity, and insurable interest lays a solid foundation for navigating the intricacies of insurance policies.

Types of Insurance Plans

Insurance extends far beyond the realm of health coverage. Explore the diverse array of insurance plans available to consumers, each tailored to address specific risks and needs.

Health Insurance: Your Key to Wellness

Prioritize your well-being with comprehensive health insurance coverage. From routine check-ups to unforeseen medical emergencies, a robust health insurance plan ensures you receive the care you need without undue financial strain.

Property Insurance: Safeguarding Your Assets

Protect your most valuable assets, whether it’s your home, vehicle, or prized possessions, with tailored property insurance solutions. By mitigating the financial repercussions of unexpected damage or loss, property insurance provides peace of mind and security.

Life Insurance: Securing Your Loved Ones’ Futures

Ensure your loved ones’ financial stability and security with a carefully chosen life insurance plan. By providing a financial safety net in the event of your passing, life insurance offers invaluable support during challenging times.

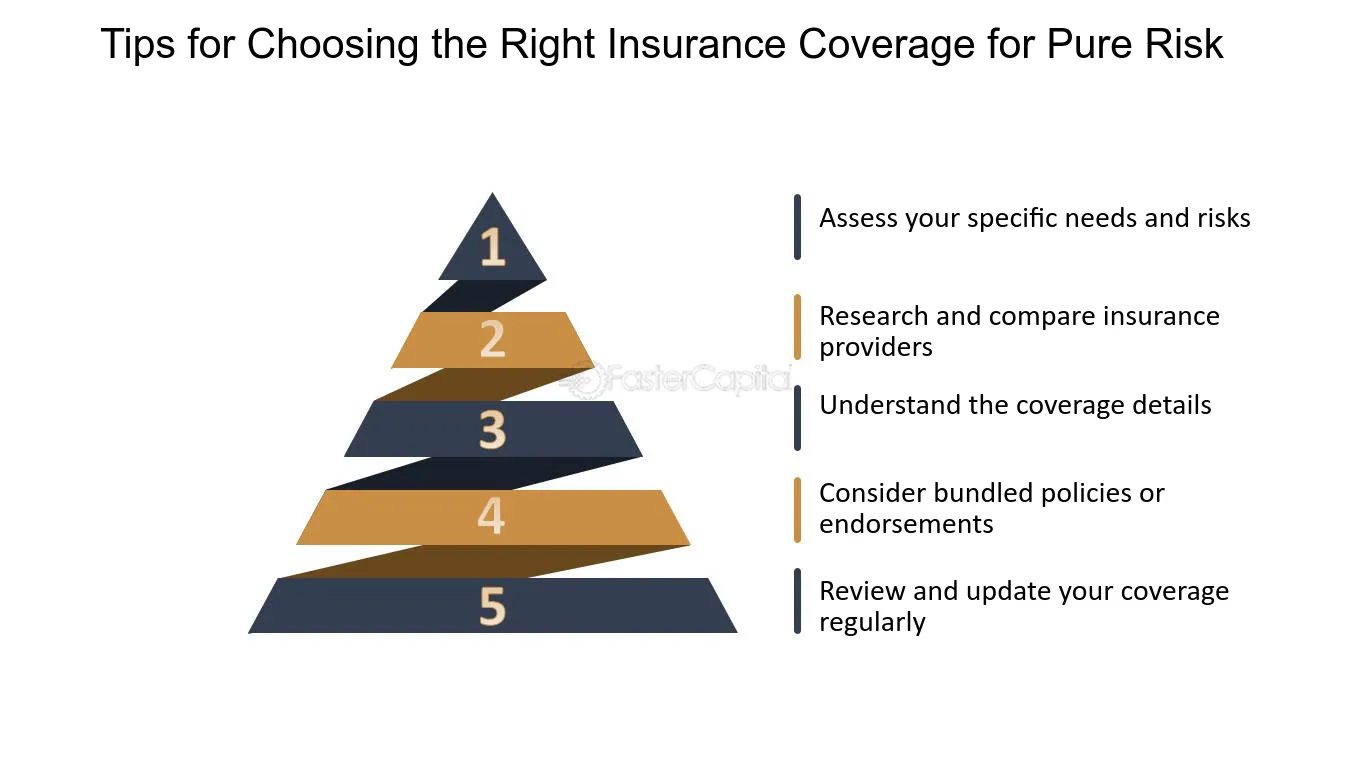

Navigating Insurance Coverage

Choosing the right insurance plan entails evaluating various coverage options to align with your specific needs and priorities. Explore the factors to consider when assessing insurance coverage to make informed decisions.

Assessing Coverage Needs

Begin by assessing your unique insurance needs based on factors such as lifestyle, dependents, and financial obligations. By understanding your coverage requirements, you can tailor your insurance plan to provide optimal protection.

Comparing Insurance Providers

With numerous insurance providers vying for your attention, selecting the right insurer can be a daunting task. Learn how to effectively compare insurance providers to identify reputable companies that prioritize customer satisfaction and reliability.

Researching Insurance Providers

Conduct thorough research to evaluate insurance providers’ reputations, financial stability, and customer service quality. Utilize online resources, customer reviews, and independent ratings to gain insight into each insurer’s track record.

Maximizing Insurance Benefits

Beyond selecting the right insurance plan, maximizing your policy’s benefits ensures you derive maximum value from your coverage. Discover strategies for optimizing your insurance benefits and leveraging additional perks offered by insurers.

Utilizing Preventive Services

Take advantage of preventive services and wellness programs offered by health insurance providers to proactively manage your health and well-being. From annual check-ups to vaccinations, preventive care plays a crucial role in maintaining optimal health.

FAQs (Frequently Asked Questions)

What factors should I consider when choosing an insurance plan? When selecting an insurance plan, consider factors such as coverage options, premiums, deductibles, network providers, and customer service quality. Assess your specific needs and priorities to ensure the chosen plan aligns with your requirements.

How do I determine the right coverage level for my insurance plan? Evaluate your financial situation, lifestyle, and risk tolerance to determine the appropriate coverage level for your insurance plan. Consider factors such as income, assets, dependents, and potential liabilities to gauge your coverage needs accurately.

Is it advisable to bundle insurance policies with the same provider? Bundling insurance policies with the same provider can result in cost savings and convenience. However, it’s essential to compare bundled rates with individual policy premiums to ensure you’re getting the best value for your coverage needs.

What steps should I take if I encounter difficulties with my insurance claim? If you encounter difficulties with your insurance claim, promptly contact your insurer’s customer service department for assistance. Document all communication and provide thorough documentation to support your claim.

Can I make changes to my insurance policy after purchase? In many cases, you can make changes to your insurance policy after purchase, such as adjusting coverage levels or adding additional riders. Contact your insurance provider to inquire about policy modification options and any associated fees.

How can I ensure I’m getting the best insurance rates? To secure the best insurance rates, compare quotes from multiple insurers, maintain a good credit score, bundle policies for potential discounts, and explore available discounts based on factors such as safe driving habits or home security measures.

Conclusion

Navigating the myriad options in the insurance marketplace can be overwhelming, but armed with the knowledge gained from The Ultimate Guide to Choosing the Right INSURANCE Plan, you’re empowered to make confident, informed decisions. By understanding insurance basics, exploring coverage options, and leveraging insider tips, you can select a plan that provides comprehensive protection and peace of mind.